UPDATED FOR 2024...

See If You Qualify For The Personal And Business Capital Businesses LOVE

(Click Play To Watch The Video Below And Then Make Sure To Scroll Down To See The "Success Fee" For This Expert Done-For-You Set Up, And Why It Is The Way It Is)

(P.S. Want to see a text version too? Click here to see the readable version)

What Is The Personal/Business And Startup-Loan?

The personal/business and startup loan are similar lending services with similar qualifications (shown below) that offer you a convenient way through creative-credit based financing to borrow when you need to pay unexpected bills, invest in new cabinets for your kitchen, use it for ANY business reasons like starting a business, you're a non-startup, buying equipment, growing and expanding, etc. in the form of Term Loans/installment loans, Lines of Credit (LOC) or personal and business credit cards at 0% interst. It's low rates and easy process makes it a great alternative to medium-high rate MCA Funding solutions as well as others.

You Are Eligible If You Have ALL Of The Following For Personal And Or Business Funding...

For Personal Funding (Term Loans and sometimes Personal Lines Of Credit) First:

1. Have $50,000 In Annual Revnue - Adjusted Gross Income (Taxes Or Paystubs Verifiable)

2. 700+ FICO Scores On ALL 3 Consumer credit bureaus

(Don't have the credit scores but have a "credit parnter" who can help and or just high balances and or just 680+ FICO Experian Credit? Keep reading and See the section below reading "If you don't qualify...")

3. Zero (0) time in business is fine (We Just need proof of identity and proof of income. If W-2 employee, will need last two pay stubs. If self-employed, will need most recent business and personal tax returns. Banks will go by Adjusted Gross Income.

4. No more than 4 bank inquiries per bureau in the last 12 months (Ideally no more than 3 - Does NOT include secured inquiries like Auto loans and Mortgages).

5. No more than 3 unsecured accounts opened in past 12 months (Ideally no more than 3 - Does NOT include secured inquiries like Auto loans and Mortgages).

6. Less than 40% Utilization on Each revolving accounts (Ideally less than 30%)

7. Strong Credit History is best (Creditworthiness)

8. No Recent Negative Items - No late payments in 1 year, no charged off accounts

9. No bankruptcies at all showing on credit file

10. No open(unpaid) collections or judgments

11. No late payments in 1 year, no charged off accounts

12. Seasoned major bank card trade line $3,000 limit +. Must have minimum of 1 open revolving account with at least 2 years of history or more. Ideally two cards of $5,000+ (totaling $10,000) if not one at $10,000+

**If scores are less than 700 only due to high balances on revolving accounts, may still qualify - AFTER Conditions are met, but if you have 680+, please scroll down to see the alternative option.**

NOTE: Too many NEW Tradelines and other unsecured (non-collateralized) loans you just received can reduce your amount or completely decline the file because this is based on your debt-to-income ratio (DTI).

INTEREST RATES: The APR’s (Annual Percentage Rates) on the loans are typically between 7%-15% depending on the applicant’s creditworthiness and the selected term (applicant will be presented with 1-5 year terms if not up to 7 years if so).

How to Qualify for Personal Funding (Fast Track) -Not available right now with my provider here:

- Personal credit score on all 3 bureaus 670+

- No bankruptcies within last 5 years

- Any type of individual revolving credit/charge account with 6-18 months of history and $500+ limit.

**For Fast Track: Collections, lates, previous derogatory accounts, new accounts/inquiries are ok to a certain extent as long as it is not overly excessive and there are not too many combined credit issues.***

For Business Funding (0% Interest Business Credit Cards, could be personal 0% cards too and more):

1. Personal credit score on all 3 bureaus 700+

(Don't have the credit scores but have a "credit parnter" who can help and or have just high utilization? Keep reading and then See the section below that reads "If you don't qualify...")

2. No more than 4 bank inquiries per bureau in the last 12 months (Ideally no more than 3 - Does NOT include secured inquiries like Auto loans and Mortgages).

3. No more than 3 unsecured accounts opened in past 12 months (Ideally no more than 3 - Does NOT include secured inquiries like Auto loans and Mortgages).

4. Under 40% utilization on each revolving accounts (Ideally under 30% is best).

5. No bankruptcies at all showing on credit file

6. No open(unpaid) collections or judgments

7. No late payments in 2 years, no charged off accounts

8. Have a Seasoned major bank card trade lines $5,000 limit + but $10,000+ with one card is great to have. Must have minimum of 2 open revolving account with at least 2 years of history or more. (Can have 1 open revolving account if there is an aged mortgage with at least 2 years of history, or 1 open revolving account and aged entity over 2 years).

**If scores are less than 700 only due to high balances on revolving accounts, may still qualify - AFTER Conditons are met if possible - But again, if you have under 700 credit and have 680+ on ALL 3 bureaus, please read below on the alternative.**

See the FULL text version of the different services here:

Click here to see ALL the National Corporate Credit Details And Qualificaitons

If you don't qualify...

Don't meet the credit requirements but have a "credit partner" who can help?

Most likely a business partner, family member or friend who can temporarily assist you by guaranteeing your credit lines until you can increase your credit rating and take over that responsibility through balance transfers or other strategies. Over 40% of our clients start with a credit partner. For them to guarantee the credit cards, they need to be at least a 10% owner, otherwise it will just be limited to the "personal" funding

>>Click here to share with them this document so they can look through all the details<<

(P.S. You can also share with them this site and have them save it for when they are ready)

Don't meet the credit requirement score(s) and more but have at least 680+ FICO Experian Credit and on ALL 3 consumer credit bureaus?

>>Click here to see my see my second recommended credit-based alternative<<

Don't meet these credit requirements and possibly have bad credit AND have 3 months of business/personal bank statements with at least $3k in revenue on your lowest month in the last 90 days to get funding with?

>> Click here to see my #1 Recommended Alternative Up To $2,000,000+<<

P.S. If you're purchasing equipment as a startup (not trucking) through an equipment lender as an alternative to the personal/startup loan, it's best to have a 650+ FICO with 10%-30%+ down and if you are in Trucking, it's best to have a 700+ score with similar downpayments, tradelines (5 is best)...

and if you meet this and would like to see an equipment specific lender (and you have the downpayment), see the "up to $2m" link above, otherwise continue with this personal/startup loan

The Key Benefits of Working With Us And More Details

Experienced Staff

(Hassle-free process at your fingertips with a team of people who know how to help)

Fast Response Time And Time To Approve

(24 hour approvals with 1-2 or 3-5 weeks to fund)

Certified Expertise

(Experts at your fingertips who have helped 100,000's of people)

Low Interest

(6%-18%+ Interest rates keeps your costs lower! Or 0% Interest Business and Personal credit cards)

Great Terms

(6-12 months to 3,5,7 Year Terms so you can have more time and better repayments)

How It Works (In 6 Fast And Simple Steps)...

You will work directly with Myself and my team at GoKapital to...

STEP 1: Enter Your Information

Figure out how much you could get between $20,000-$300,000 (more or less) with a Free application and Soft pull with the help of our digital online safe and secure application process.

STEP 2: We will review your submission

We will review your submission (after a soft pull) and I'll get back to you with an update to see if you have pre-qualified or not and email you over the information.

STEP 3: Moving Forward

If you're satisifed with the pre-qualification and would like to move forward, then we'll get you setup with my account manager and move things there and we'll be there for an online form to complete and more.

STEP 4: Collect Documents

Therafter, I will collect your documents needed to go through underwrititng and that depends on the service but for the personal side could be Tax returns (with more), on the busines side - EIN Letter, Articles Of Organization/Certification of Formation, drivers license.

STEP 5: Underwrite and or Prepare Your List of banks and more to go after

After collection of documents and review, I'll let you know how to move forward with an offer/soft offer to a hard offer, and if business cards you wil get to review the banks list and see if you approve, and if so, move forward.

STEP 6: Funded!

Get the funds from the personal and or business side and use the installment and or revolving credit how you choose and finally be able to power yourself and your business forward so you can be at your best while being able to manage your cash-flow and revenue growth.

SUCCESS FEE: There are no upfront nor any recurring fees. Once the funding has been established, the company is due its Success Fee, which is a percentage of the total aggregated funding up to the maximum flat fee. The Success Fee can be paid with the new funding.

Usually you’ll see 15% of a success fee which is Very reasonable especially when you’re getting MAX funding as opposed to the alternative which is trying to do it on your own and get it wrong (many people do, and they don’t have the right leveraged relationships like we do...

You can walk into a bank or apply online for multiple or one card (even the wrong one(s)) and potentially get like $10k if anything but with us get even 4x the amount at $40k+, it’s night and day)…

You also have to keep in mind the benefit of exceeding your repayment and how you'll use your funds to potentially double, triple, or quadruple your revenue and or perhaps save more and keep your business afloat which keeps your repayments low over time compared to other services.

This is normal and expected. And the fact that you can pay the success fee with the credit lines is great. If it were to drop, it would be to 12% But that ONLY really happens more so on the credit card level when you have no credit cards from like the top banks, you have strong history, and can even get high enough approvals (still hard to drop from 15% though).

PLUS: Other services out there will likely charge you higher than 15%+ on credit lines and for personal term/installment loans and things like these it's normally 20%-30%, and others charge 9.9%+ or so but you're likely not getting the best look and service, and or ask you to buy into a course of $5,000 or so upfront and then whether they tell you or not...

if they help you do the credit applications, they’ll likely charge you that 20% and even higher I've seen (especially for the personal term loans). This way on the backend of the total credit lines and personal funding is best to do.

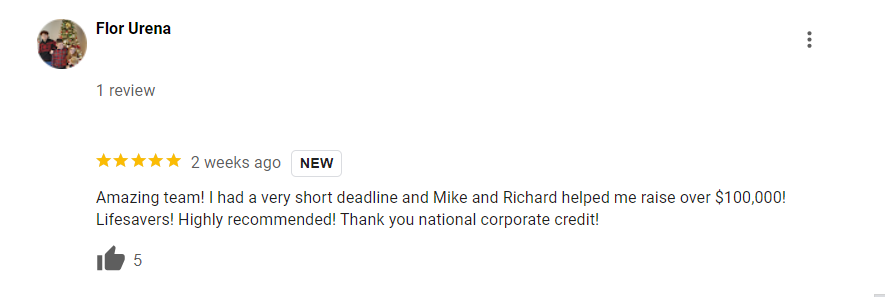

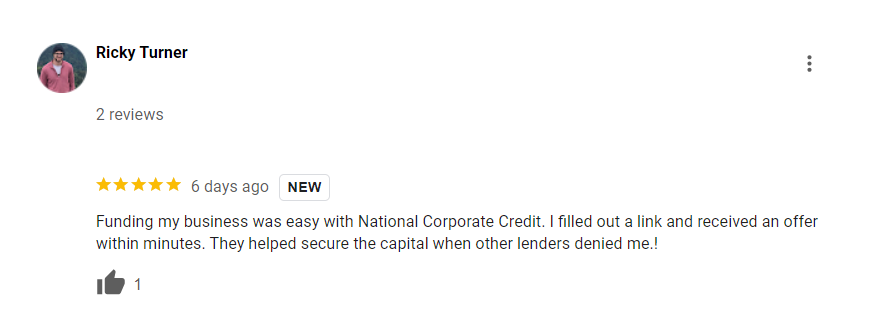

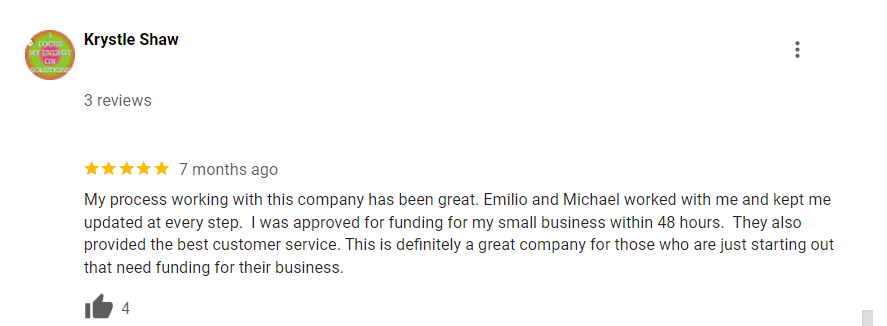

See What These Three Satisified Clients Had To Say...

It's YOUR Money, Go Ahead And Claim It Before It's Too Late!

The personal and startup loan are VERY Popular right now but requirments could change at any time and you'll find it harder to get (look at what's happened with the "SBA EIDL Funding" and even the "PPP Funds" - changed and Gone!) and you'll lose your chance to put the money to work for your business and for many more reasons. Do you want to be "that" person sitting on your couch living in regret thinking to yourself "what if?" Or the one who said "I Did it?"

About Michael (The Business Loan Broker, Funding Expert And Pre-Underwriter/Underwriter)

Michael started like any and every 9-5 employee with the dream to become their own boss as a Business Owner/Entrepreneur - In the start of his journey and further down the road, he had to figure out the ropes to getting business financing to build, grow, expand, and even get out of a tight pinch...

going through the struggles and troubles of getting funding let alone find the right source with the right partnership and roadmap was the challenge. Eventually he did find his way, and after funding his multiple businesses, he decided to use his knowledge and expertise to help others get business funding through the lens of an education first approach with personalization and customized business funding second as well as so you wouldn't have to go down the wrong path and making mistakes after mistakes like he had. That's when Viral Funding Solutions was born.

Ready to get your Personal/Startup Loan? Click here to get started